Have Concerns About Your Card?

Transaction Disputes

Everything you need to know to ensure your debit and credit card transactions are accurate, and how to address it if they are not.

Need to Dispute a Charge?

Learn what you can do to dispute an Authorized Charge or Unauthorized Charge.

Authorized Charge

Authorized Charges are not fraudulent, though they may be charges you do not agree with. This could include a billing discrepancy, duplicate transaction, or unfulfilled refund.

To dispute Authorized Charges:

- Contact the Merchant. Always start with the merchant – this often will be the quickest way to resolve a dispute.

- Contact PSECU. If working directly with the merchant is unsuccessful, you can file a dispute with the card issuer – that’s us. You can reach us at 800.237.7328, extension 3872.

Unauthorized Charge

Unauthorized Charges are any transaction that you didn’t make and you didn’t permit anyone else to make. Often, unauthorized charges result from card theft – either from a stolen card or a compromised card number.

To dispute Unauthorized Charges:

- File a dispute in digital banking. Here's how:

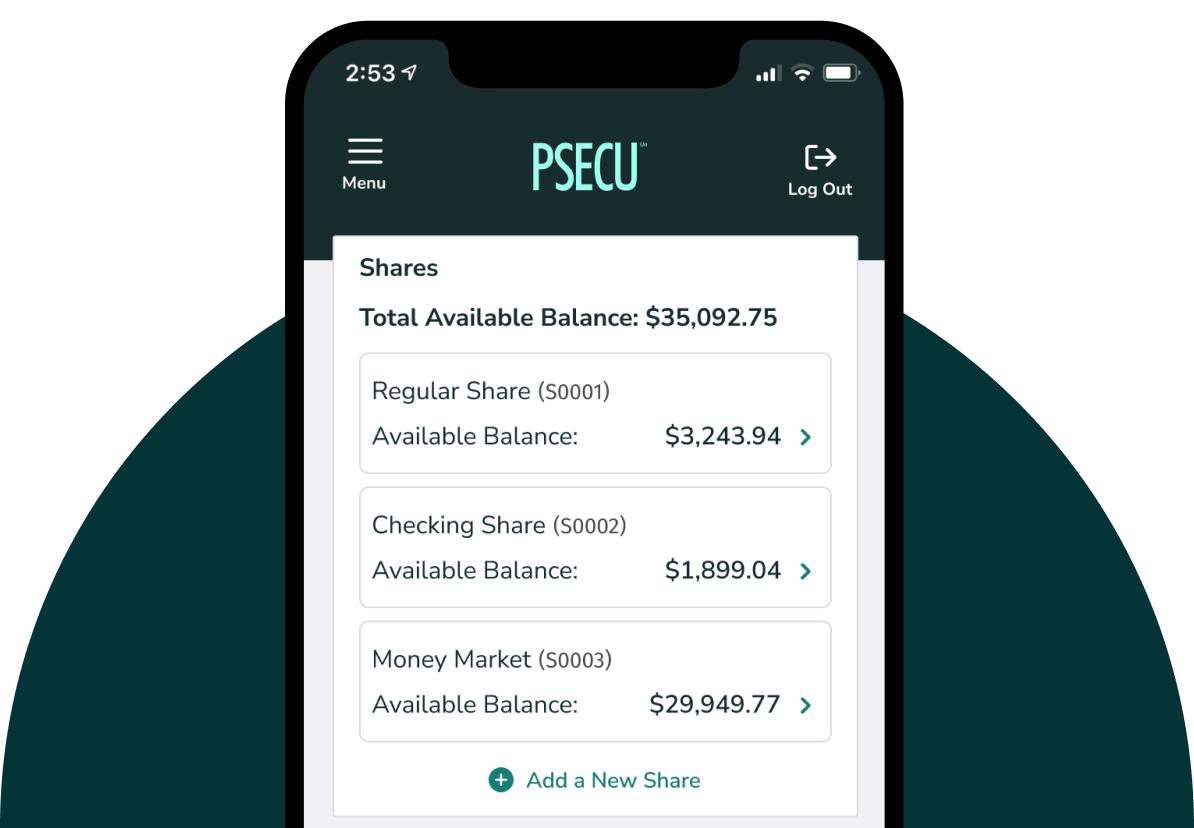

- Log into digital banking.

- Navigate to your card’s transaction history.

- Select Dispute Card Transaction.

Please note: Transactions older than 18 months can’t be disputed via digital banking and must be handled by phone. You can reach us at 800.237.7328, extension 3872.

- Upon submitting a dispute in digital banking, your card will be closed and you'll have the option to order a new card.

- We'll investigate unauthorized charges on your card. Once the dispute is initiated, it is reviewed within 10 business days and typically resolved within 90 days. You can track your dispute in digital banking by viewing your card’s transaction history and selecting Track Dispute to view any active disputes.

Browse Common Questions

-

In digital banking, go to your card’s transaction history. From there, you can choose to initiate a card transaction dispute for a credit card or debit card transaction. Transactions older than 18 months can’t be disputed via digital banking. For those transactions, you’ll need to call us at 800.237.7328, extension 3872.

-

If you file a dispute for an unauthorized transaction, your current card will be closed and you will have the option to order a new card. The new card will have a different card number than the one you closed. You will need to update your card details for any recurring payments you may have scheduled.

-

In digital banking, go to your card’s transaction history and select Track Dispute to view any active disputes. Disputes submitted prior to [DATE] will not be available in digital banking.

-

Your dispute will be initiated and reviewed within 10 business days and typically resolved within 90 days.

-

You may select up to 5 unauthorized transactions per dispute through digital banking. You may submit more than one dispute if needed. Please note that previously disputed items will not be available to select for an additional dispute. You may also call us to to dispute more than 5 transactions at 800.237.7328, extension 3872.

-

In digital banking, you can view transaction and merchant details by selecting the posted transaction and selecting Visa Merchant Details.

-

Yes. You can cancel a dispute in digital banking. Navigate to your card's transaction history and select Track Dispute. Once you locate the transaction, you can expand the details and select Cancel.