Have you begun saving for your retirement? The amount people need to save for retirement varies greatly from person to person, based on a host of things ranging from current income to desired lifestyle to whether or not you’ll receive a pension.

However, the basic steps used to determine an average of what you should save by age and income stay the same.

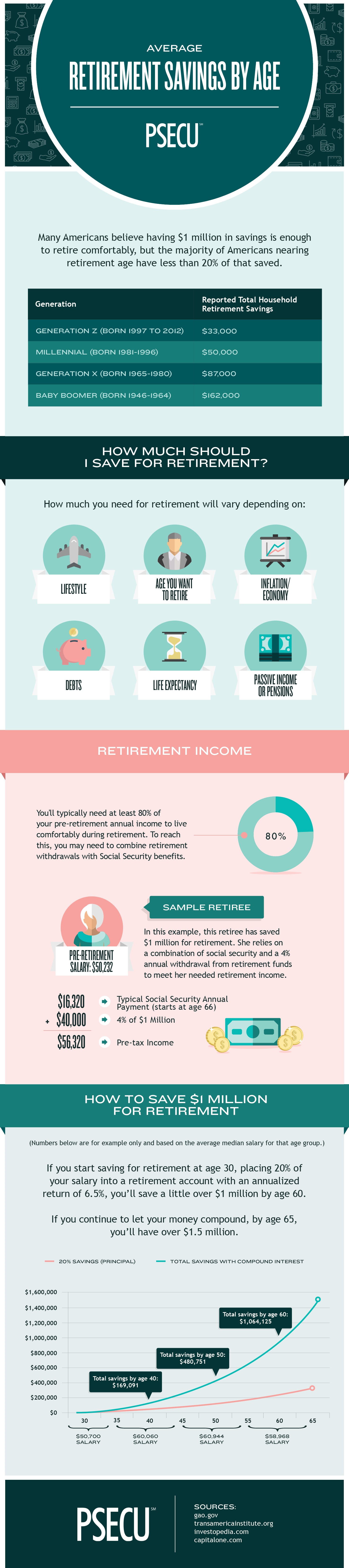

Your target retirement income should be at least 70% to 85% of your pre-retirement income, though this could vary based on your individual circumstances and desired lifestyle. If you start saving for retirement early enough, meaning before age 30, by saving 20% of your income each year in a reliable retirement savings account, you could have enough money to cover your target retirement income by the time you are 59½ years old.

In the chart below, we’ve outlined what this looks like year-to-year for someone earning the average American income.

![]() This work is licensed under a Creative Commons Attribution-NoDerivs 3.0 United States License. If you like our graphic, feel free to share it on your site as long as you include a link back to this post to credit PSECU as the original creator of the graphic.

This work is licensed under a Creative Commons Attribution-NoDerivs 3.0 United States License. If you like our graphic, feel free to share it on your site as long as you include a link back to this post to credit PSECU as the original creator of the graphic.

Hitting the $1 Million Mark

Many people set their retirement goal at $1 million. In order to get there, you should start saving as early as possible, as soon as you get your first job. The more money you save early on, the more compound interest it accumulates. Remember, the power of compound interest only manifests over time. When you start saving before age 30, you can put away less than $200,000 from your paychecks over time and still turn that into $1 million by the time you retire.

If you follow the chart in the graphic and reach the $1 million mark at retirement and you only withdraw 4% each year, your retirement account will continue to increase if the U.S. economy continues to see a 6.5% annualized return.

Retirement Savings and Social Security

Throughout your working lifetime, you contribute money to a federal insurance program called Social Security, which you begin to receive money from when you reach retirement age as specified by Social Security or if you become unemployed or disabled. While this is a welcome source of income for Americans, the typical monthly Social Security payment will not be enough to cover all of a retiree’s expenses. Retirees typically need to supplement that income through savings they accumulate throughout their working life, such as money from a 401(k) - an employer-sponsored retirement plan.

Years ago, many people could rely on pensions for some of that money. Pensions draw on a fund contributed to by workers and/or their employers during their employment. Those funds are then dispersed to retirees. However, many companies have dropped their pension plans in favor of 401(k)s, which allow employees to determine how much they contribute and what level of risk they want to expose their investments to. Your company may contribute to your 401(k) by matching a percentage of what you personally put into the account each year from your paycheck. How much an employee receives depends on how much they save, the percentage their employer matches, and, if applicable, what level of risk the employee chooses. On the other hand, a pension is a regular payment that the employee will receive once they retire, typically at age 65, and will continue to receive for the rest of their life.

Retiring Early? Understand Your Options

According to the Social Security Administration’s website, you can start your Social Security retirement benefits as early as age 62 or as late as age 70. Your monthly benefit amount will be different depending on the age you start receiving it. You can access your 401(k) without penalty after age 59½. If you tap into it before then, you will be assessed a monetary penalty.

Some people set the ambitious goal of retiring early - even before age 59. While impressive, keep in mind you’ll need a different way of saving, because you’ll need your money sooner. For assistance determining what your best options are for managing your retirement income, you should seek the help of a trusted financial advisor.

If you’re looking for ways to save for other purposes, as well – a future project, trip, or emergency fund – PSECU has accounts that can help you with that. Consider a certificate or a money market.

Find more money management tips and resources on our WalletWorks page.

The content provided in this publication is for informational purposes only. Nothing stated is to be construed as financial or legal advice. Some products not offered by PSECU. PSECU does not endorse any third parties, including, but not limited to, referenced individuals, companies, organizations, products, blogs, or websites. PSECU does not warrant any advice provided by third parties. PSECU does not guarantee the accuracy or completeness of the information provided by third parties. PSECU recommends that you seek the advice of a qualified financial, tax, legal, or other professional if you have questions.