Interest rates are on the rise, including those for mortgages. Depending on what interest rate you’re currently paying, it may make sense for you to refinance now before rates go any higher. But how do you know for sure that you should refinance your mortgage?

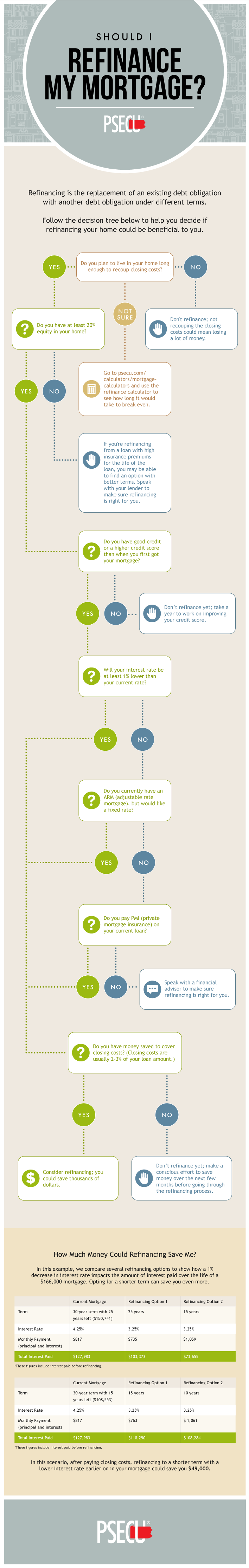

If you’re uncertain about whether refinancing would pay off, take a look at our decision tree below to help you determine whether doing so could save you money. Answer each question to the best of your ability. By the end, you’ll have a better idea about whether refinancing is something you may want to consider. You can also use our refinance calculator to better analyze your current situation.

How Much Does It Cost to Refinance a Mortgage?

It may not make sense for you to refinance your mortgage if you won’t recoup your closing costs. These costs may include:

- Loan origination fees

- Title insurance

- Appraisal

- Deed-recording fees

While closing costs vary depending on your loan terms, they usually run at least several thousand dollars. To make refinancing worth it, you’ll typically want to make sure the closing costs don’t outweigh the savings you’ll see from refinancing. There are some situations where it may be possible to roll closing costs into refinance transactions. In these cases, the closing costs are rolled into the loan amount. It’s best to speak directly with a mortgage specialist to learn if this is a good option for you.

Learn more about the costs and documents you need for refinancing here.

Should I Refinance to Remove PMI?

PMI stands for private mortgage insurance. Your lender may require you to pay PMI, which protects them in the event you stop making your payments, if you have a down payment worth less than 20 percent of the home’s value. So, for instance, if you buy a home worth $100,000, you’ll likely have to make a down payment of greater than $20,000 to avoid PMI.

Depending on the terms of your mortgage, you may have to refinance in order to get rid of PMI. In those instances, it may be worth it to seriously consider refinancing so you can remove that additional cost from the remainder of your loan.

Should I Refinance to Get a Lower Interest Rate?

It may seem like refinancing for a lower interest rate is the obvious choice. In many cases, that’s correct. However, there are other factors to weigh when you’re considering refinancing to make sure that refinancing will save you money.

To see if it makes sense to pursue a lower interest rate, calculate how much you’d save by refinancing your mortgage to the new interest rate, then subtract any additional costs of refinancing, such as closing costs. You should consider refinancing only if you’d still save more money after closing costs and any other lender fees have been subtracted.

Improving Your Credit Score Before Refinancing

Higher credit scores can help you qualify for loans from more lenders who know they can trust you based on a solid history of paying your bills on time and not running up huge debts. Qualifying for loans from more lenders gives you more freedom to pick the loan that’s best for you. If your credit score could use some work, here are a few tips to help bump it up.

- Pay down your largest credit card debts

- Make your payments on time, setting monthly reminders on your phone if you need to

- Keep a low balance on all of your credit cards

If refinancing makes sense for you, see if we have a home mortgage offer that will fit your needs. And be sure to check out more money management tips and resources on our WalletWorks page.

This work is licensed under a Creative Commons Attribution-NoDerivs 3.0 United States License. If you like our graphic, feel free to share it on your site as long as you include a link back to this post to credit PSECU as the original creator of the graphic.

Insured by NCUA.

The content provided in this publication is for informational purposes only. Nothing stated is to be construed as financial or legal advice. Some products not offered by PSECU. PSECU does not endorse any third parties, including, but not limited to, referenced individuals, companies, organizations, products, blogs, or websites. PSECU does not warrant any advice provided by third parties. PSECU does not guarantee the accuracy or completeness of the information provided by third parties. PSECU recommends that you seek the advice of a qualified financial, tax, legal, or other professional if you have questions.