With some exceptions, when you make a purchase, you need to pay tax on it. Sales tax tacks on a small percentage to the price of certain goods. In Pennsylvania, it’s 6%, with an extra 1% added in Allegheny County and 2% added in Philadelphia. Hotel taxes add to the cost of staying in a hotel or motel, and fuel taxes add to the price of gasoline.

Although you only need to pay tax once when you make most purchases, there’s one type of tax that you need to pay annually – property taxes. Property taxes are usually based on the value of your home and are due each year. You need to pay them whether you own the house in full or are still making payments on the mortgage.

Property taxes vary wildly. Not only do they differ from state to state, but they also vary from county to county within the same state. Factors that influence property taxes in an area include:

- Value of the property. The size of a property, its location, and its amenities all influence its market value. Different counties use different methods of determining the value of a property. Some areas look at the current market value of a house and its land. Other areas use an older value, such as the value of the property five or 10 years ago. In some cases, counties might use a portion of the house’s value, such as 10%, when calculating the property tax.

- Assessment rate. The assessment rate is how much of the property’s value a county uses when calculating the tax owed. For example, if the county uses the full value of a property, then the assessment rate is 100%. If it uses a tenth of the property’s value, the assessment rate is 10%.

- Millage rate. Some counties use a mill rate to calculate property tax. A mill is $1 for every $1,000 of the property’s value. If a county has a millage rate of five, then a person would pay $5 for every $1,000 of the property’s value.

- Percentage. Some counties use a straight percentage, such as 1.3% or 2.1%, to determine how much property tax a homeowner owes. If the percentage is five, then a person would pay $5 for every $100 of the property’s value.

- Effective tax rate. If a county uses mills and an assessment rate that’s not 100%, then a bit more math is needed to figure out how much the property tax is. For example, if the mill rate is five (0.005) and the assessment rate is 75% (0.75), then the effective tax rate is 0.00375. If a property has a market value of $100,000, then a homeowner would need to pay $375 in property taxes.

The type of tax charged on the property also affects how much a homeowner will have to pay each year. For example, within a county, both the county and the township the property is located in might have their own tax rate, expressed as either a millage rate or percentage.

For example, Monroe County in PA has township and county taxes. Township millage rates can vary – the millage rate for Polk Township is just 4.3, while the millage rate for Pocono Township is 16.1.

The school tax is another type of tax that affects how much homeowners pay in property taxes. School taxes are a type of property tax that go toward funding for area public schools. As with the rate charged by counties, the rate of school tax varies from district to district. In Philadelphia (where there’s just one district), the school district tax is 0.7681%. In Monroe County, the school district tax millage rate ranges from 135.29 to 177.86, based on the district.

How Much are PA Property Taxes?

Since every county in PA sets its own property tax rates, there’s no one set rate for the entire state. The state government stays out of the property tax fray, leaving the decisions on how much to charge and how to calculate the tax up to counties and municipalities.

Although you’re going to see a considerable difference in the property tax rate based on where you purchase a home, the average property tax rate for Pennsylvania was 2.02% in 2017.

If you think you may have trouble meeting your tax obligations, there are several programs in PA that can reduce the amount of property tax you owe or offer you a rebate on property tax paid.

Many areas of PA offer a homestead exemption to homeowners who live on their property. A homestead exemption typically reduces the taxable value of a home by a certain amount. While the amount varies from county to county, it is the same for homes within the same county. In Philadelphia, for example, the homestead exemption reduces the value of the property by $40,000, lowering the amount of tax a homeowner needs to pay.

Another program is the Property Tax/Rent Rebate Program, which is supported by the PA Lottery. The program is designed for Pennsylvanians over the age of 65 (over age 50 if a widow or widower) and for people over the age of 18 with disabilities. The program offers a rebate of up to $650 per year to homeowners who earn less than $35,000.

Depending on the county or municipality, a variety of other tax-reduction programs might be available. These can include programs that reduce property taxes for seniors, members of the armed forces or veterans, or people who have lived in their homes for a certain length of time.

Whether or not you qualify for one of these programs, you can also file an appeal to have your assessed property value lowered, therefore lowering your tax liability, as well. If you’re interested in learning more, you’ll want to consult with a qualified tax professional to determine if this is the correct route for you.

How Does PA’s Property Tax Compare Nationally?

Compared to the rest of the U.S., PA property taxes are on the high side, but still aren’t as high as in some states. Pennsylvania has the sixth highest average property tax rate out of all 50 states. Our neighbor, New Jersey, takes the top spot when it comes to property taxes, with the state average being 2.28%. Hawaii has the lowest average property tax rate at just 0.34%.

Other states with property taxes that are higher than Pennsylvania’s include:

- Illinois (2.22%)

- Vermont (2.19%)

- Texas (2.15%)

- New Hampshire (2.06%)

Although Pennsylvania doesn’t make the top five when it comes to highest average property tax rates, it’s worth noting that one area of the state does have the highest effective tax rate out of 217 metropolitan areas. Scranton, PA, has an effective tax rate of 3.93%, almost double the state average.

How Much Revenue is Generated by Property Taxes?

According to data from the U.S. Census Bureau, state and local governments brought in more than $108 billion in revenue from property taxes during the second quarter of 2018. Much of that revenue – more than $101 billion – went to local government, while less than $8 billion was collected by state governments.

The portion of total revenue that property tax makes up varies based on region. For example, in the Midwest, states took in more than 7% of their total revenue from property tax. In the Northeast, about 1.6% of total revenue came from property tax, while property taxes accounted for less than 1% of state and local government income in the South.

The Counties with the Highest Property Tax Rates in PA

Three counties in PA with some of the highest property taxes are:

- Monroe County. Monroe County, which includes Stroudsburg and the Poconos, has the highest average tax rates in the state, with millage rates ranging from 164.29 to 229.15. Property taxes vary across the county based on the township a home is located in and the millage rate for the school district. Properties in the county are assessed at 25% of their market value. Homestead exemptions range from $2,268 to $3,368. In Monroe County, school district taxes make up most of the property taxes charged.

- Allegheny County. Allegheny County is another PA county with higher-than-average property taxes, with an average effective tax rate of 2.15%. The millage rate for the county is 4.73, while millage rates for school districts in the county range from a little over nine to more than 29. The county uses a base year method for assessing the values of properties. Its last assessment was in 2013, using 2012 as a base.

- Berks County. The average effective tax rate in Berks County is about 2.04%, with rates ranging from just over seven mills to more than 43 mills.

Although it’s difficult to pinpoint a specific reason why property taxes are so high in these three counties, the funding needs of area schools and school districts often have something to do with it. For example, in 2016, the Stroudsburg School District in Monroe County faced a $5.6 million deficit and approved a 5.9 mill property tax increase in an attempt to make up the difference.

The Counties with the Lowest Property Tax Rates in PA

Three counties in PA that have some of the lowest property taxes are:

- Bedford County. Bedford County has some of the lowest property taxes in PA, with a mill rate of three for the county and school district millage rates ranging from around eight to just over 11.

- Sullivan County. Property taxes in Sullivan County are also among the lowest in PA, with an effective tax rate around 1.46%.

- Philadelphia County. Having Philadelphia on this list might surprise some. The city and county reassess property values annually and use the full market value of a property to determine the tax due. Real estate tax in Philadelphia was 1.3998% in 2017. Some of that (0.6317%) was for the city, and the rest (0.7681%) was for the school district. The city offers a 1% discount to people who pay their property tax bill at least a month before the due date.

One reason why property taxes in some counties is considerably lower than in others is that certain counties might find other ways to bring in revenue. For example, Philadelphia was considering a 4.1% property tax increase for 2019. However, to avoid having to increase property taxes, the City Council introduced a package that would find income from sources such as a wage tax and a city grant that would cut the budget in other departments.

Why Are There Variations in PA Property Tax Rates?

Why is there so much variation in property tax rates across PA? In many ways, it has to do with how local governments are funded and how much money school districts need. Property values also affect tax rates.

Pennsylvania municipalities and counties typically use a mill levy when calculating property tax rates. A mill levy calculates the amount of revenue a county, township, or school district will need for the upcoming year. It also looks at the total value of the property in the area, whether it’s within the county as a whole, the township, or the school district’s service area.

For example, the total property value within the service area of a school district is $2 billion. The school district needs $200 million to operate for the year. The county needs $2 million to operate. To earn enough money to operate, the school district would need to earn $10 for every $1,000 in property value (10 mills, 200 million divided by two billion).

Meanwhile, the county needs to earn $1 for every $1,000 in property value to raise $2 million for the year. Its mill rate is one (two million divided by two billion). All told, the mill rate is 11, or 0.11.

If the assessed value of a person’s home was $100,000 and the mill rate is 11, they would owe $1,100 annually.

Since property values can differ widely throughout a county and a state, there’s going to be a considerable amount of variation in how much school districts and counties need to raise to have enough to cover their budgets. In areas where property values are high, counties can charge lower tax rates and still receive a sufficient amount of revenue. Where property values are low, counties might need to charge higher rates or struggle to bring in enough income for the year.

The features and amenities in a county or town can affect property tax rates. For example, a county with many public services, such as trash pickup, recreational centers, and public parks, might need more money to pay for those things compared to a county without garbage pickup or recreational offerings.

Other factors also contribute to the variation in tax rates. For example, in some areas, property owners get tax abatements, meaning they don’t have to pay tax on their home or property for a specified number of years. Tax abatements might be beneficial for people who buy a home and can avoid paying taxes on it for several years. However, the abatements can mean that other homeowners need to pay more in property taxes to make up the difference. Homestead exemptions and other incentive programs also affect overall tax rates.

Additionally, property tax rates can change annually as counties and municipalities adjust their budgets, and the market value of property in an area increases or decreases.

How Do I Calculate My Property Tax?

There’s a lot that goes into calculating your home’s property tax. First, you need to know the value of your home. The taxable value of your home isn’t necessarily what you paid for it, though.

Depending on how your county assesses properties, the value could be much lower than the price you paid, and even considerably lower than what you would get if you were to put your home up for sale today. In some cases, though, counties do end up assessing a home for more than a person paid for it or more than they would get if they sold the property.

Although there’s room for variation, a reasonable general estimate of a home’s assessed value for real estate tax purposes is anywhere from 80% to 90% of its market value.

Once you have a ballpark figure of your home’s value, it’s time to look at the mill rate or tax rate in your area. You can often find this information on the website of your county. Some counties also reveal the assessment rate they use, which can help you get a more accurate idea of your property tax. In some cases, county websites have a look-up tool that allows you to type in your property’s address and get an idea of the assessed value of your home and the tax owed.

But if your county doesn’t have a calculator or look-up tool, you can still estimate your property tax by multiplying the mill rate by the assessed value. For example, if the mill rate in your area is 10 (0.01), and your home’s value is assessed at $100,000, your property tax for the year is $1,000.

Why Property Tax Matters When You’re Looking for a Home

When you’re considering buying a home, you probably realize that there’s more to the “price” of the home than the amount a seller is asking for. Several factors influence how much home you can afford to buy and whether or not a house that seems to be within in your budget actually is.

One of those factors is property tax. Unless you get a house that offers a property tax abatement for many years, there’s no way to get around paying the tax. And, depending on where you buy, the tax rate could add thousands of dollars per year to your mortgage payment.

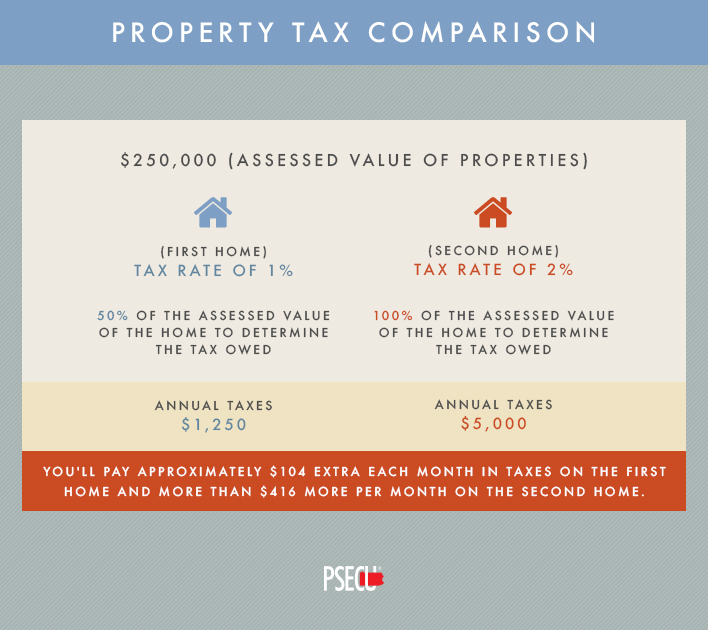

For example, let’s say you’re looking at two properties. Both have the same asking price of $250,000, but one is in a county with a tax rate of 1%, and the other is in a county with a tax rate of 2%. The county with a 1% tax rate uses 50% of the assessed value of the home to determine the tax owed. The county with a 2% tax rate assesses the property at 100% of its value.

Annual taxes on the property in the county with the lower tax rate are $1,250. Meanwhile, annual taxes in the county with the higher rate are $5,000, which is considerably more. You’ll pay an extra $104 or so each month in taxes on the first home and more than $416 more per month on the second home. A mortgage calculator can give you a good sense of how much property taxes can affect your monthly payments.

Keeping property taxes in mind when budgeting for a home and a mortgage can give you a more realistic sense of the price range of a property and can help keep you from falling in love with a home that’s out of your budget. At PSECU, we offer a variety of mortgages for first-time and returning homebuyers and are happy to help you choose the home loan that best meets your needs. Contact us today to learn more about our mortgage options.

The content provided in this publication is for informational purposes only. Nothing stated is to be construed as financial or legal advice. Some products not offered by PSECU. PSECU does not endorse any third parties, including, but not limited to, referenced individuals, companies, organizations, products, blogs, or websites. PSECU does not warrant any advice provided by third parties. PSECU does not guarantee the accuracy or completeness of the information provided by third parties. PSECU recommends that you seek the advice of a qualified financial, tax, legal, or other professional if you have questions.