You’ve heard us talk about our low rates and how they can help you save, but how exactly does that work? Read on to learn about how interest rates affect the cost of a loan and see examples of how lower rates can save you money both now and in the long run.

How Do Interest Rates Affect the Cost of a Loan?

When borrowing money from a financial institution, you’ll typically have to pay that money back with interest. Traditionally, your monthly payments go toward repaying the principal (the original amount you borrowed) and paying interest on the amount you borrowed. The interest rate you’re given, also called the Annual Percentage Rate or APR, affects the total cost of the loan because it determines how much interest you’ll pay.

How Does Interest Add Up?

In addition to the interest rate itself, other factors affect how much interest you’ll pay on a loan, both on a monthly basis and over time. These factors include:

-

Loan type: Interest rates may be calculated differently for installment loans - like a mortgage or auto loan - than for revolving credit loans, such as a credit card. Installment loans are typically paid back in set payments that include predetermined principal and interest amounts, while the interest on revolving credit loans depends on how much of a balance you’re carrying on the card.

-

Loan term: Installment loans have a loan term, which is the amount of time the lender expects you to pay the loan in full. Usually, the longer the term, the more you’ll pay back in interest over the life of the loan.

-

Compounding: When the interest on a loan compounds, the interest you’ve accrued becomes part of the loan’s principal balance. Then, the next time interest is calculated, you’ll pay interest on this new principal amount. How often the interest on your loan compounds will affect how much you’ll end up paying in interest.

Impact of Low-Interest Rates

While these other factors play a large role in how much interest you’ll pay over time, the actual interest rate (i.e., the APR) is often the most impactful when considering the total cost of a loan. Take a look at the following examples to see how choosing a loan with a low-interest rate can lead to significant savings.

How a Low APR Credit Card Helps You Save

In a perfect world, you wouldn’t spend more than you have. But at times, you may find yourself needing to carry a balance on a credit card to make ends meet, buy necessities like groceries, or finance a car repair. In either case, choosing a credit card with a low APR is especially important to minimize how much you’ll need to pay back.

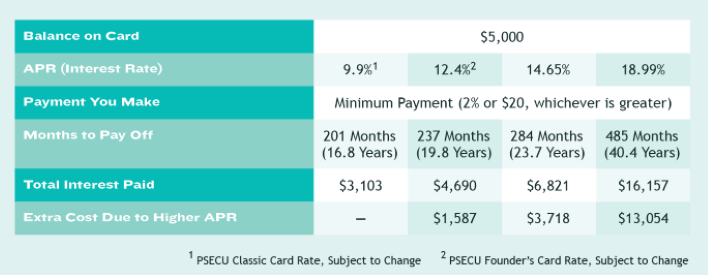

Consider the following scenario where you have a $5,000 balance on your credit card. The table below shows how various APRs can affect the time it would take to pay it off, as well as the total amount of interest paid.

In the table above, you can see the impact that APR has on the length of time to pay off debt, as well as the total interest paid. Considering that the national average APR on a credit card currently sits at about 21%, you can also see how choosing one of our credit cards could help you save big if you’re planning to carry a balance.

How a Low APR Car Loan Can Help You Drive Home Savings

Whether you’re shopping for a new or used car, having a low APR can make the difference between a car loan that fits your budget and one that stretches your finances too thin.

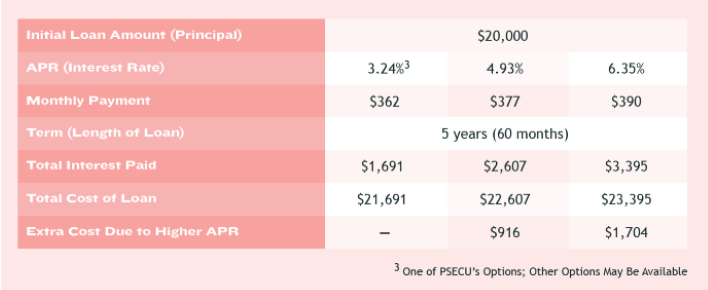

Consider the following example using a $20,000 car loan. The table below shows how various interest rates impact not only your monthly payment but also the total cost of the car for a five-year (60-month) car loan.

Again, you can see how low auto loan rates allow for more savings compared to other APRs you may see when shopping around for a car. PSECU offers auto loan refinancing for both existing PSECU auto loans and auto loans that are rolled over from other financial institutions. Lowering your rate can help you keep the car you love while creating some extra room in your budget.

Managing Mortgage Payments is Easier with a Lower APR

A mortgage is likely the largest loan you’ll ever take out. Even small increases in interest rates can lead to increased costs when you’re borrowing such a large amount of money.

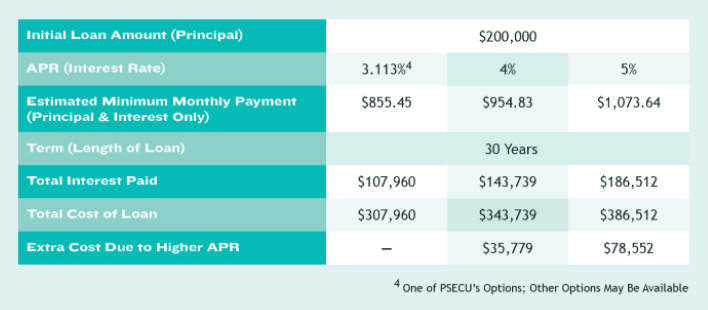

The example below shows how APR impacts monthly payments and total home cost when taking out a 30-year, $200,000 mortgage.

While it may not sound like much to increase your mortgage rate by 1% or less, as you can see in this table, the financial impact is significant in both the short and long term.

Start Saving with Our Low Rates

Whether you’re in the market for a car, shopping for a home, or need a credit card, we have loan options that can help save you money. Check out our current rates today.

The content provided in this publication is for informational purposes only. Nothing stated is to be construed as financial or legal advice. Some products not offered by PSECU. PSECU does not endorse any third parties, including, but not limited to, referenced individuals, companies, organizations, products, blogs, or websites. PSECU does not warrant any advice provided by third parties. PSECU does not guarantee the accuracy or completeness of the information provided by third parties. PSECU recommends that you seek the advice of a qualified financial, tax, legal, or other professional if you have questions.