You’re in the checkout line, ready to pay, and you suddenly find yourself fishing around for the card you want to use or correct change. Sound familiar? If you’re tired of digging through your wallet, looking for credit cards, cash, or coupons, it’s time to get organized.

Optimizing your wallet makes it easier to find what you need while keeping your personal information safe and secure. Here are a few tips to get you started.

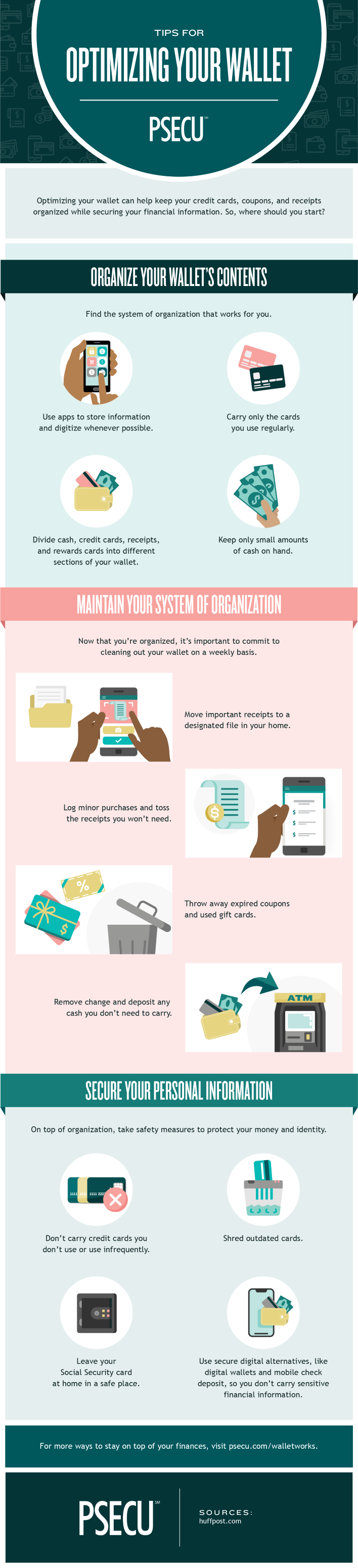

Clean Out and Organize Your Wallet

The first step to organizing your wallet is to simplify its contents. Consider these tips to streamline the following items:

- Cards: Only keep cards you regularly use in your wallet. You may want to keep your debit card handy in case you need cash, and have a backup credit card available in case the one you typically use gets declined. If you can, digitize everything else. For example, you might be able to use an app to house digital store loyalty cards.

- Cash: While more and more retailers accept, or even prefer, card payments, you might want to carry a small amount of cash with you. There may be times you need it, whether it’s coins to pay a parking meter or cash for a pizza delivery tip.

- Receipts: If you need to hold on to receipts, dedicate a section of your wallet to them. However, it’s a good idea to only keep receipts in your wallet for a short time. Make it a habit once you get home to document the purchase in your preferred budget tracking tool and then determine if you need to keep it any longer. If it’s a simple purchase for groceries, you may no longer need it once you’ve tracked it in your budget. But, if it’s for a large item that has a warranty or an expense that you’ll be claiming in your taxes, transfer the receipts to a file or digitize them so they’re easily accessible.

- Coupons: Coupons can help you save money, but they can also contribute to clutter. Consider switching to online or digital coupons to cut down on the amount of paper you need to carry around. If you want to stick to physical coupons or if a digital version isn’t available, keep them in a separate envelope, rather than mixed in with the other contents of your wallet.

Keep Your Wallet Clean

Once you’ve cleaned out your wallet, remember to maintain your new system of organization. Sort through your wallet at least once a week to remove any clutter.

You can log receipts, digitize them, or simply toss the ones you know you don’t need. If you have coupons, discard any that have expired. Check the expiration dates on your debit or credit cards to ensure they’re active. If you have gift cards or prepaid cards, toss them if they’re empty or put them in a safe place if they still have a balance and you’re not planning on using them in the near future.

It’s a good idea to sort through your cash, too. Put loose change in a jar to take to a coin counter when full. If you need quarters frequently for parking or laundry, set those aside in a separate jar so you don’t have to search for them when you need them.

Protect Your Information

An organized wallet is a more secure wallet. When you only carry around the cards you use regularly, you’re keeping the ones you don’t from getting lost or stolen if you misplace your wallet.

There are other steps you can take to keep your personal information secure, too. Be cautious about the identification you carry. You typically only need to have one form of identification with you, such as a driver’s license. Leave other types of ID, like your Social Security card or passport, in a secure spot at home.

If you haven’t already, consider using digital banking tools and services to add an extra layer of security to your finances. For instance, rather than writing and mailing checks for bills, use your financial institution’s bill payer service to minimize the chances of having your personal information lost or falling into the wrong hands in the mail. Or, if you frequently receive checks, use your financial institution’s mobile app to deposit these checks with your smartphone so you don’t have to carry them around until you have time to get to an ATM.

Lastly, when you’re discarding any contents from your wallet that contain sensitive financial information, remember to dispose of it in a secure way. For example, shred any expired debit or credit cards, as well as any receipts that may have identifying information on them.

Take Control of Your Finances with PSECU

Optimizing your wallet is a simple way to organize your finances and secure sensitive information. To learn more tips on money management, visit our blog.

The content provided in this publication is for informational purposes only. Nothing stated is to be construed as financial or legal advice. Some products not offered by PSECU. PSECU does not endorse any third parties, including, but not limited to, referenced individuals, companies, organizations, products, blogs, or websites. PSECU does not warrant any advice provided by third parties. PSECU does not guarantee the accuracy or completeness of the information provided by third parties. PSECU recommends that you seek the advice of a qualified financial, tax, legal, or other professional if you have questions.